What’s the problem and what does it mean?

Women do 2.6 times the amount of domestic work than men → This eats into the time they have for paid work → They earn less. Now know this: research shows that women are disproportionately impacted during a recession. Yet, women are less involved in public, political, economic and financial debates.

Instead we have a marketplace that discriminates against women: there’s a pay gap, a promotion gap, a pension gap! World over, 1 billion women are excluded from the formal financial system.

What this means is that women are in a perpetual state of long-term poverty.

How do financial markets affect this?

In the same way that poverty is sexist, financial crises are also sexist: when one hits, it has gender specific impacts on unemployment, part-time work, lower salaries, child care, and allowances. Not to say that these don’t impact their male counterparts, just that women were disproportionately affected by the crisis and post-crisis austerity measures.

But women don’t need a financial crisis to get a raw deal from the financial services industry: they’re more likely to be denied a mortgage and pay higher interest rates than men, despite having better credit profiles. Banks discriminate against pregnant women and make it harder for them to get business loans than men, charging female entrepreneurs around 1% more than men. Even micro-finance institutes – often focused on helping women – can make things worse if they push women into prostitution or suicide when they can’t repay loans.

Amidst all this, strong action from consumer protection agencies is needed – especially when banks take advantage of women and miss-sell financial products to them.

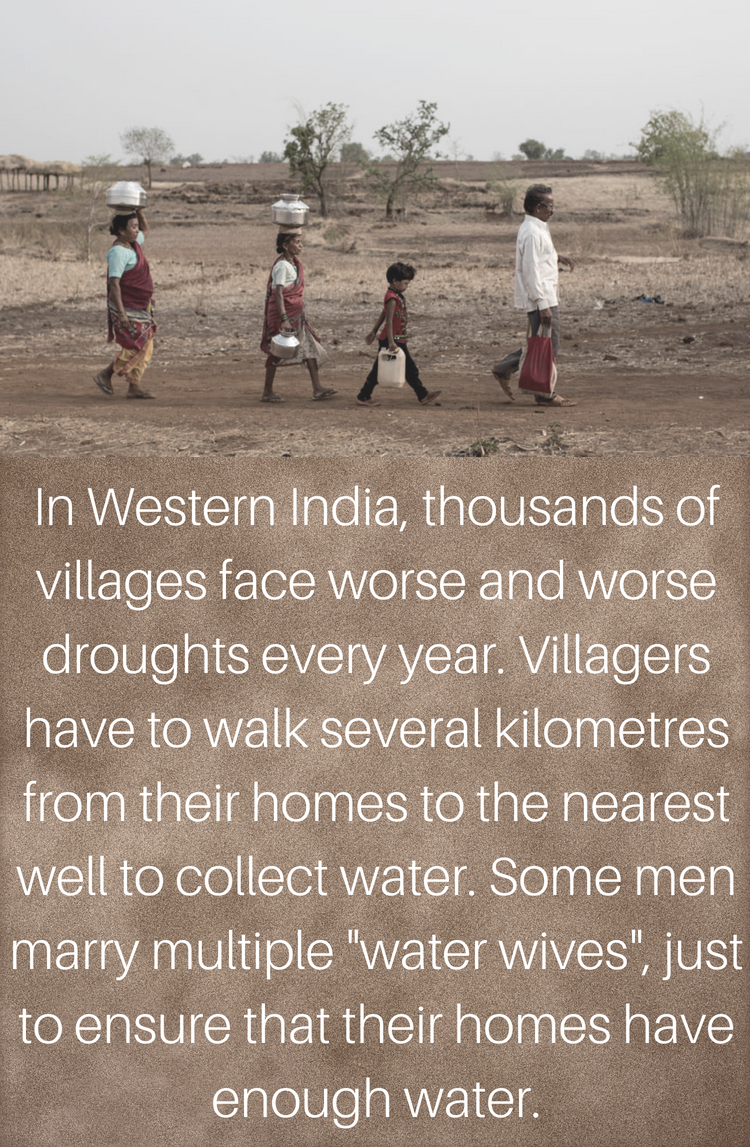

Gender equality could even lead to fewer failures on the path to sustainability, as it is women who will face the effects of climate change more than men.

Inside the financial sector, there is evidence that women can make better fund managers than men because of their risk-averse attitudes. In fact, the management and boards of nearly all the failed Wall Street banks and financial institutions were predominantly male. Could women have prevented the 2008 Great Recession? Some think so.

Despite that, senior women in finance in the UK occupy less than a quarter of board roles and get paid 40% less than their male counterparts.

What this means for you

It seems hard to imagine an economy and a financial sector that works for the good of all humanity if women remain marginalized.

Women are slowly but steadily finding their seat on the table, but this progress needs to be much faster.

What’s the best way forward?

- GOOD FINANCIAL SERVICES. Everyone should have access to basic, low-cost, transparent and un-exploitative financial services. Financial workers should be free to act in the best interests of customers.

- EFFECTIVE REGULATION. Financial policymakers (legislators/regulators, supervisors, international bodies and central banks) should be fully representative and politically accountable for making finance serve people and planet.

- FIGHTING INEQUALITY.Financial services should be designed and regulated to reduce their contribution to discrimination and inequality. Tax avoidance and secrecy havens are closed, debt relief is made possible for over-indebted countries. A fair taxation system redistributes wealth from the 1% to middle and working classes and from large corporations to the public purse.

Don’t let finance worsen the gender gap, make it improve it!

Source

Gender Balance Index, OMFIF

African Women United Against Microcredit Vultures, Fatima Martin

Women In Financial Services, Olivier Wyman

Benchmarking Of Diversity Practices At The Eu Level, European Banking Authority

Impacts Of The Global Financial Crisis On Women’s Rights: Sub Regional Perspectives, Association For Women’s Rights In Development

The Hidden Crisis, Women Lobby And Oxfam

Also read

The International Labour Organisations take on the financial crisis and the

gender dimension

Huff Post’s coverage on how critical it is for gender inclusion in financial markets

This conversation on saving the soul of microfinance