What’s the problem?

Something close to a miracle has occurred in human health in recent years: since 1960, average life expectancy across the world has increased from 52 years to 72 years! But averages do not tell the full story.

In the U.S. recently, a woman got her leg stuck between a train and the platform, cutting her to the bone. She begged for passers-by not to call an ambulance, saying she couldn’t afford the fee.

In southern Africa, the government of Lesotho spends more than half of its healthcare budget on a single hospital – built under a private public financing scheme that pays a 25% profit to the financing partner. In Greece, heroin use among men over the age of 35 nearly doubled after the financial crisis and recession.

What does this mean?

After the financial crisis, millions of people lost their jobs, and many governments chose to reduce public spending and increase taxes (a.k.a. austerity). Healthcare was put under severe pressure, affecting its accessibility, affordability, quality and availability.

Previously, health spending in Europe had been growing at 4.6% a year for a decade but it dropped to zero growth after the financial crisis, despite Europe’s aging population. Governments cut hospital beds, froze nurses’ pay, they even introduced extra charges for medicines and facilities.

Unsurprisingly, people got sicker.

Northern Italy suffered a spike in heart attack admissions; the number of British people self-reporting ‘bad’ or ‘very bad’ health rose by 3.8%; the number of stillborn babies in Greece leapt by a third, reversing a 42 year downward trend.

Mental health also suffered. Rates of alcohol abuse, homicide, and road traffic accidents all increased after the financial crisis. In the U.S., Canada and Europe, experts estimate there were 10,000 extra suicides as a result of stress and job losses caused by the global financial crisis…

How do financial markets affect this?

Finance has played a key role in funding medical research and care, but over-financialisation can make people sicker. The financial crisis triggered cuts in healthcare spending, leading to more illnesses.

Ever-rising personal debt is making more people sick from anxiety or pushing them into a debt-health trap, where ill health makes it hard to earn an income to service debts.

Lower public health spending has encouraged health privatisation, even though private healthcare is not more efficient or effective than public healthcare. In fact, compared with the public sector, private practitioners are often worse at treating infectious diseases and tend to prescribe unnecessary drugs and procedures. Some even change a patient’s diagnosis because of insurance company rules! Where private health insurance is involved, the premiums and exclusions can put healthcare out of reach for poor or unemployed people, or push them into debt.

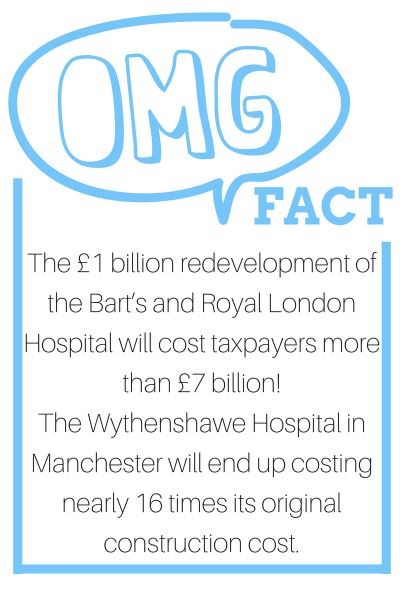

Hospital construction is also being financialized. The U.K. used public-private-partnerships (PPP) to pay for schools, hospitals and public transport but the policy turned out to be a costly mistake. PPPs add massively to the cost of financing: interest rates are more than double what governments pay, while PPP investors can earn up to 30% annual profits, often taking their profits offshore to avoid tax.

As more U.K. hospitals get into difficulty, the government has condemned PPPs as “looting”. Despite that, the country still promotes PPP abroad, leading to charges of hypocrisy.

Pharma research is another area where the impact of finance has been controversial. Malaria and tuberculosis account for 12.5% of the global burden of disease but only get 1% of all funding for health R&D. Pharma firms are highly profitable but Wall Street puts them under pressure to cut R&D spending.

How it affects you

Privatisation of healthcare forces people into debt. Across the world, the cost of health care has reached historical highs (irrespective of government spending on healthcare). Insurance is becoming a thing for the wealthy and employed, forcing others into debt because of unexpected medical costs. Unaffordable health → Social inequalities → Burden of debt → Negative impact on health (stress, fatigue, depression, diseases etc.). This is a vicious cycle. It is no wonder that countries like France, U.K. and Germany which enjoy free healthcare for all are against its privatisation.

What’s the best way forward?

- LESS FINANCIALISATION. Society must become less dependent on the private financial sector to access basic needs such as housing, health, education etc., and the role and size of private finance should be reduced more generally.

- INVESTING NOT BETTING. More useful investment for socially and ecologically sustainable activities; less ‘casino’ financing for short-term, unproductive and speculative activities. More relationship-based finance.

- FINANCE THAT’S SAFE FOR SOCIETY. The financial sector should be less interconnected and its firms able to absorb their own losses. No private firm should be too-big-too-fail.

There’s a ‘cure’ for this health care problem. Click here to ‘inject’ your energy into changing finance.

Sources

Health Inequalities, The Financial Crisis, And Infectious Disease In Europe, European Centre For Disease Prevention And Control

Austerity And The Unraveling Of European Universal Health Care, Dissent Magazine

The Body Economic – David Stuckler, Youtube/The RSA

Also check out

How the Great Recession hurt Americans, their lives and their retirements by CNBC

This long (but worth it) read on how European policy responded to the 2008 financial crisis plus health care double whammy, by WHO

Video footage of the woman who got trapped by a subway train, but was afraid of being put in an ambulance