What’s the problem?

Although the world has never produced as much food as today, the Food & Agriculture Organisation (FAO) estimates that 815 million people around the globe are still underfed. After decreasing for nearly 15 years, the proportion of malnourished people rose again in 2016. Meanwhile, food-related public health issues as well as agriculture-induced nature depletion are on the rise too.

Part of this global problem is that extensive, highly mechanized livestock raising is a major factor of environmental degradation and climate change (pollution and GHG emissions), and deforestation: extensive cattle ranching, for instance, accounts for 80% of deforestation in the Amazon.

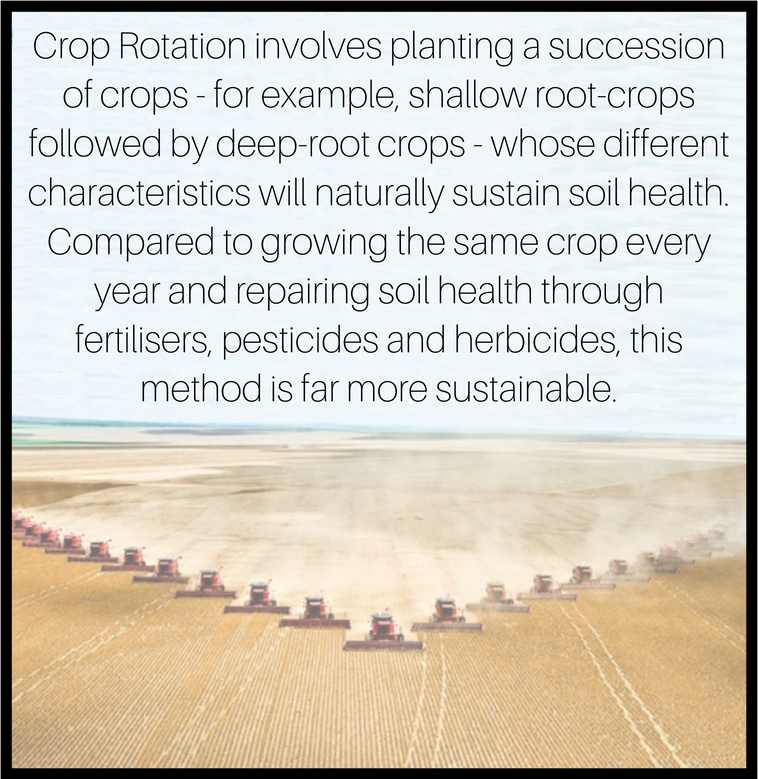

At the same time, the long-term effects of intensive agriculture, which uses chemical fertilizers and pesticides to increase our agricultural productivity, are starting to do just the opposite. We now face problems of soil depletion, increased health hazards and intensifying food insecurity.

What does this mean?

In some parts of the world, food is taking up a higher and higher share of people’s household budgets. In 2007 and 2008, rising prices of food led to massive riots in Senegal, Egypt, Burkina Faso and several African and Asian countries, because people could not afford the most basic food commodities such as bread, corn or rice.

Meanwhile, more and more farmers are being pushed into debt because of low farm gate agricultural prices and the high cost of rents and capital goods.

Food Speculation

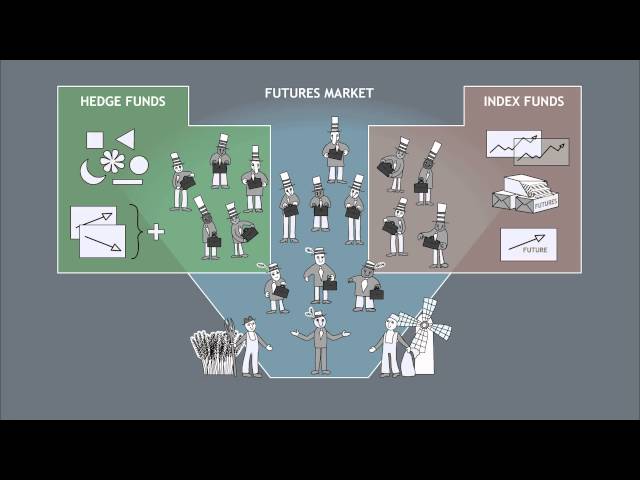

Considerable food speculation by investment banks, hedge funds and pension funds affect short-term prices, while farmers seldom benefit from market price increases; profits are captured by trading companies, investors and supermarkets instead. All over the world, farmers are experiencing a deterioration in their living conditions.

How does finance affect this?

International Trade: Global demand and supply has a strong impact on food and agriculture. For example, European main exports (processed food, dairy, pork, poultry, wheat) are largely encouraged by CAP (Common Agricultural Policy) subsidies given to EU farmers and food processors. But CAP, coupled with EU’s free trade agreements, has created a situation of surplus food. This ends up being dumped in developing countries, altering the tastes and food habits of these nations. Meanwhile, EU imports of frequently lower production standards also generate unfair competition with European production, and induces the occupation of large farmlands abroad (like soybean for instance), the opportunity cost of which is local staple food production there.

Betting on food commodities: Financial markets regularly bet on food price increases (e.g. in the case of a flood or drought) or price decreases (e.g. in case there is a better harvest), without actually trading the goods that they are betting on. In fact, 80% of financial trade related to food today is pure speculation and has virtually nothing to do with food production.

The huge amount of money involved in these transactions means that food prices are no longer being determined by factors like production costs or by operations geared towards increasing agricultural productivity; they are being determined by forces that have no agricultural interest.

Betting on land: A rise in food prices has further triggered a surge in land investments. Investors with no connection whatsoever to agriculture have pushed land prices up, signaling even more investors to join this global land rush.

This has serious consequences.

– It encourages land grabbing: Large financial institutions and private companies make land deals that give them full control of the land. In the process, they expel the original inhabitants of the land (often with no compensation). This concentration of land favors larger agricultural exploitations, which in developing countries often display lower productivity of land compared to smaller farms.

Photo credit:alffoto

– It harms the environment: In developed economies, the financial sector usually promotes larger, more capital-intensive farming over smaller, more sustainable farming techniques. As the financial and corporate sector gets more control over food production, farmers are prevented from developing local production. This could harm sustainability and food security. Intensive mono-cropping can increase yields in the short-term but deplete soil over the long-term. Yet financial pressures may discourage farmers from moving to organic or other more sustainable farming techniques, such as crop rotation.

Basically, the food and agricultural sector is being overly influenced by speculative and financial interests.

What this means for you

The ‘financialisation’ of food and agricultural land affects us directly. Increasing food prices mean that millions across the globe are denied their right to affordable food. Moreover, overly mechanized agriculture in developed economies also partly contributes to rural unemployment. A profit-seeking motive in agriculture implies that production of poor-standard and unhealthy foodstuffs is encouraged. And the dominance of capital-intensive agriculture takes a toll on both the farmer, the consumer and the environment.

What’s the best way forward?

- LESS FINANCIALISATION. Society must become less dependent on the private financial sector to access basic needs such as housing, health, education etc., and the role and size of private finance should be reduced more generally.

- INVESTING NOT BETTING. More useful investment for socially and ecologically sustainable activities; less ‘casino’ financing for short-term, unproductive and speculative activities. More relationship-based finance.

We need to radically transform our food and agriculture choices

Sources

The state of food insecurity in the world, FAO (Food and Agriculture Organisation of the United Nations), 2015

The state of food and agriculture, FAO, 2016

Land grabbing and human rights: the role of EU actors abroad, FIAN and Hands on the Land for Food Sovereignty, short version and full study, 2017