What’s next for Change Finance in 2020?

10-04-2020

Over 40 activists, campaigners, citizens and researchers met online on the 27th of March to discuss this year’s Change Finance strategy. The goal was to present the coalition’s draft campaign plans, receive feedback and inform participants on how to get involved. Read a summary of the presentations held at the Strategy Meeting in this blog and learn how to get involved.

The meeting started with a take on the impacts of the COVID-19 virus on financial markets by Greg Ford, Senior Advisor for Finance Watch. He drew a comparison to the financial crisis of 2008. Unlike in 2008, we do not see a crash in the financial markets infecting the real economy. In contrast, this time the downturn in the real economy is likely to affect the financial sector – and then the flaws in the reforms after 2008 will become clear. A patchwork of half-hearted initiatives followed the last crisis. Many essential problems remained unsolved, like breaking down too-big-to-fail banks, effectively regulating the shadow banking sector or banning high-speed financial transactions that flee an economy at the slightest hint of a recession. Greg stressed that today’s financial system looks similar to the one before 2007/8: Essentially, a lot of private debt has accumulated around the world, and dangerous levels of financial leverage as well as high asset prices bear the risk of bubbles – the bursting of which can become yet again a heavy burden on societies.

Admittedly, some reforms have taken place, compared to before 2007/8. Regulators today do have a clearer picture on the overall risks in the financial system. Plus, banks have a little more capital. Yet, what if another financial crisis happened today? What if the COVID-19 virus leads to economic recession, causing massive defaults on credits and serious turmoil in the financial sector? What would this mean for corporations, banks, pension funds, state budgets – and, most importantly, for the livelihoods of people? We will answer these crucial questions in an upcoming Change Finance blog. Read the blog here.

Sustainable Finance

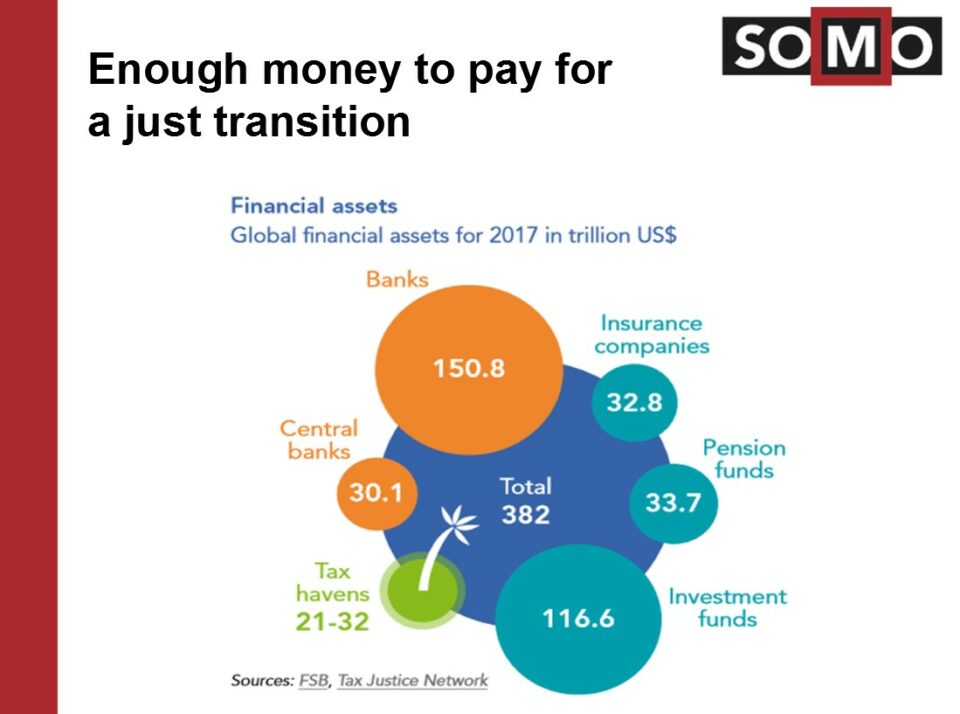

After the introduction, Myriam Vander Stichele (SOMO) presented our plans on Sustainable Finance. She emphasized that after the Corona crisis, we still need to address the impending breakdown of our climate and environment. The EU is making progress in promoting sustainable finance and fighting climate change. But something is missing. A clear definition of what economic activities are harmful to the environment and the people. Change Finance wants to tackle this gap with campaigning for a ‘brown’ and social EU taxonomy. The taxonomy would be a labelling system that should discourage money flowing into climate- and people-harming economic activities. The ultimate aim? Enforce disinvestment from fossil fuels and socially damaging activities. Besides divesting, we also need to invest, a) in the provision of public goods and services supporting the economically weak parts of the population and b) in the development of a climate friendly economy.

The European Central Bank (ECB) is injecting vast amounts of money in banks and the economy without any conditionality on climate or social aspects. Further, EU budget rules don’t give governments enough flexibility to transform their economies. It’s impossible to achieve a just and zero-carbon future without strong public investment. But the Corona crisis changed the overton window: we see that relaxing fiscal rules is possible, when there is political will. Change Finance will look into possibilities to work towards ECB policies and fiscal rules that are supporting necessary responses to the upcoming climate crisis. Myriam closed her session with the proposal of concrete moments of actions on the EU agenda. Find all moments of action in her slides.

Our work against the finance lobby

How can we make sure that any strong EU proposals on sustainable finance won’t get watered down? By exposing the dirty tricks of the financial lobby and standing up against their power. During the second thematic session of the day, Kenneth Haar (CEO) presented our work against the finance lobby. Change Finance took on this fight last year and claimed a victory in January this year: After fierce advocacy work, the European Parliament rejected the ex-lobbyist Gerry Cross as executive director of the European Banking Authority (EBA), and the EU Ombudswoman opened an investigation into the move from the former EBA executive director, Adam Farkas, to the powerful financial lobby group AFME (Association for Financial Markets in Europe).

To link our future work against the lobby with Myriam´s proposals on sustainability and climate, Kenneth proposed to focus on EU advisory bodies in the coming months. These bodies support EU institutions like the European Commission and ECB to make decisions and draft laws. But they’re dominated by industry representatives, giving citizen’s interests hardly any voice. Change Finance wants to cut off these inroads to power for the finance lobby. We want to make sure that advisory bodies have a more pluralistic representation and that the industry can’t delay and water down crucial files within the EU Green Deal and the sustainable finance agenda. Find the full presentation here.

What’s next?

In short, the COVID-19 virus will have a major impact on the financial system. And the aftershock on the functioning of finance might be even larger and unprecedented. It’s clear: we need new rules for finance. Finance needs to work for all people and not just a small elite. This is why we want to stop the financial lobby to meddle with the rules. This is why we propose concrete steps to fight for a financial system that accelerates a transition to an economy serving people and the planet.

Join us in making this transformation happen. Sign up below to one of the welcome meetings to get involved. The aim of the working groups is to coordinate and plan our next #ChangeFinance campaigns. Everybody is welcome, everybody is needed!

Working Group Welcome Meetings

Sustainable Finance: 13 May, 3-5 pm CEST. Register here.

Meeting documents

Background paper: How to campaign for a financial sector that is greener and fairer?