What’s the problem?

Our “throwaway” culture generates 40 million tonnes of e-waste and 300 million tonnes of plastic waste. Every. Year.

Everything from your inkjet printers to your smartphones and washing machines, are deliberately made with shorter lifespans forcing you to upgrade to new gadgets. This “planned obsolescence” has been a manufacturing strategy for nearly a century (since 1924), ever since a light-bulb manufacturers’ cartel shortened the output of bulbs to 1,000 hours (down from 2,000 hours).

Meanwhile, we’ve produced 8.3 billion tonnes of plastic since the material was introduced. This is about the same weight as 100 cities full of skyscrapers. As much as a truck full of this plastic is thrown into the sea every minute.

What does that mean?

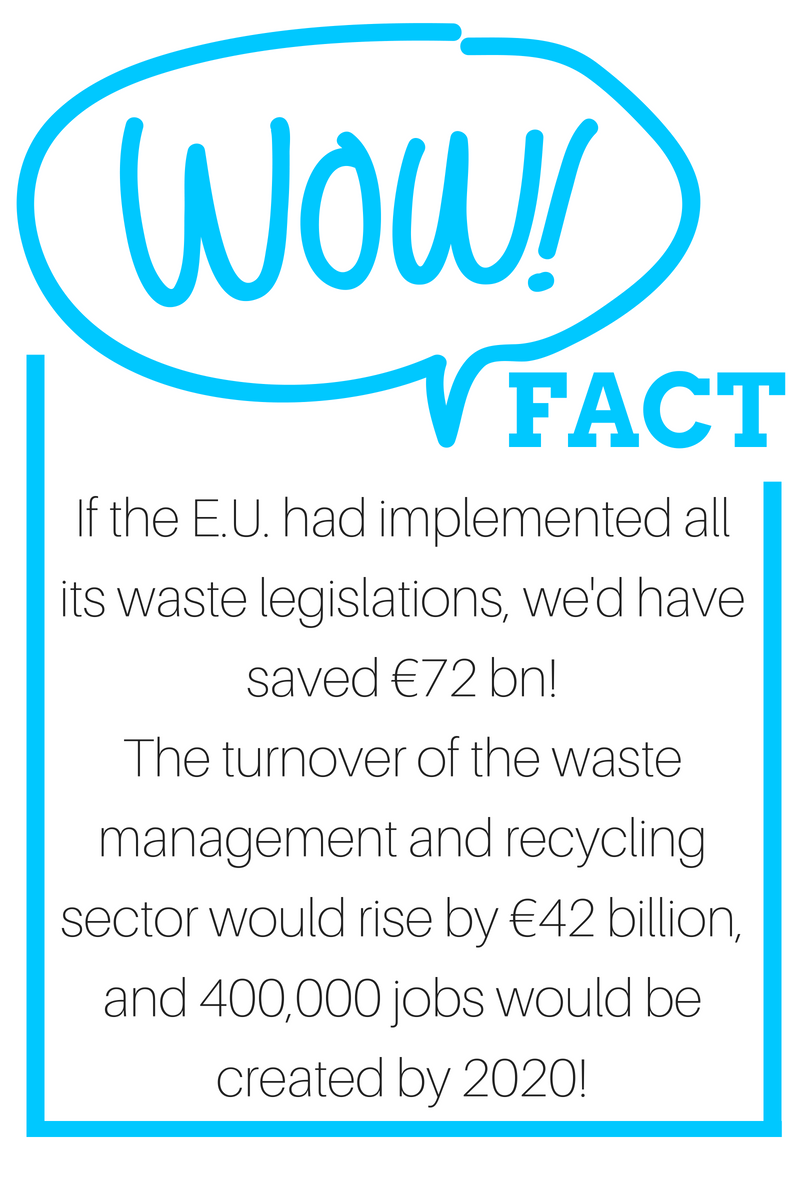

92% of the parts in your mobile phone could be reused, but hardly any get recycled. In the E.U., 40-50 million tonnes of reusable WEEE (Waste Electrical & Electronic Equipment) are produced annually, and yet France is the only country to recognize “planned obsolescence” and make it punishable. Mountains of this toxic e-waste is dumped – often in developing countries – and this costs our economy more than €44 million a year! Out of sight, so out of mind.

Plastic pollution is tougher to hide. Thanks to cases like this poor pilot whale that died off the coast of Thailand, these tiny little crustaceans with bellies full of plastic on the Mariana Trench sea-floor, and poisoned sea birds everywhere, the E.U. has finally taken notice. All plastic packaging across Europe must be recyclable or reusable – but not until 2030. Meanwhile, it’s tough to have a clean footprint – only 10% of the waste we produce is suitable for recycling!

The only solution seems to be moving to a less resource-intensive economy – one that consumes less packaging material, produces long-lasting products and is basically conscious of the finite resources we have on the planet.

How do financial markets affect this?

Up to legal limits, companies can be as wasteful as their customers and investors allow. This makes for quite a range of behaviour, even between “bluechip” companies.

In January 2018, Evian pledged to make its plastic water bottles from 100% recycled materials by 2025. On the same day, Coke promised only half as much by a deadline five years later. HP, Dell, and Fairphone are now making electronic products that can be repaired and upgraded. But Apple, Microsoft, and Samsung are going the other way, according to a report on planned obsolescence.

Ideally, investors would hold all companies to a high standard on waste. But unfortunately, the fashion for hyper-liquid financial markets means investors can trade in and out of companies in a flash and not every investor thinks long term. Indeed some, in search of short-term returns, might prefer companies that do not spend money on sustainable packaging or high quality components.

That’s not all. Extreme price fluctuations in commodity markets can hide the real prices and availability of resources, making it difficult for companies to anticipate shortages. In extreme cases, such volatility has directly undermined recycling efforts. For example in 2016, a fall in oil prices made it cheaper to make new plastic bottles than to recycle old ones. These short-term swings in the oil market put recycling plants out of business!

What this means for you

With such a market, companies are free to create ‘environmental externalities’ for future generations to deal with. These costs are not just environmental, but financial and social as well.

But it’s not all bad. As people choose more carefully what to buy, and which companies to invest in, the world’s “throwaway” culture is becoming tougher to maintain. Already the effects of regulations and new technologies are kicking in – India is building roads from recycled plastic, Sri Lanka will ban Styrofoam, China is making bags bio-degradable and there are plans for a floating ocean boom to start cleaning up the Great Pacific Garbage Patch. And if all else fails, at least we can rely on these plastic-eating moths.

What’s the best way forward?

- SAVING OUR PLANET. A massive divestment/investment shift should allow our societies to go back within planet boundaries, starting with avoiding catastrophic climate change. Central banks should play a more active role by aligning their policy with long-term society needs

- ACCOUNTABLE FIRMS. Financial firms should be accountable to their stakeholders, from customers and employees to local citizens. For example, asset managers would engage with savers; banks would include more stakeholders on their boards; and the banking sector would include more stakeholder and public banks and institutions.

- TRANSPARENCY. Citizens should easily access information and data about the financial sector and its evolution – including the actual impact of regulation. Financial firms should disclose what they are financing and how much they are charging.

Don’t “waste” time, there are “abundant” ways you can change finance!

Also check out

This analysis of the winners and losers of the war on plastics

How Apple is not the only guilty party when it comes to “planned obsolescence”

This U.N. initiative that makes sustainability at the heart of the global supply chain